WANT PROOF THAT THE REPUBLICAN PARTY IS THE OPPOSITE OF CONSERVATIVE? Joe Phillips LCSW

Conservative philosophy is supposed to be about doing the safe thing. Don’t take unnecessary chances. Build your house on the rock, not on the sand. Most rural people are of good character. Conservative means frugal to them, fiscally conservative. Not hell-bent for leather, high risk for high profit, etc. Look at the way the Republican leadership acted in the virus. Democrats chose a conservative strategy. Play it safe. Republicans threw caution to the wind to maximize corporate profits. The Republican Party is the opposite of conservative.

Examples: Republicans appeal to emotion over rational thinking. That is the opposite of conservative. Look at Republican campaign spin. They appeal to the primitive side of human nature. “The other tribes are coming to kill us.” “Build a wall,” etc.

Republicans act impulsively. That is not conservative. A conservative strategy to solve a problem would be cautious. Hold back until we have all the facts and implement a measured response.

Republicans double down after a loss. That is not conservative. Doubling down feels good emotionally, but only fools do it impulsively. Doubling down is not a good business strategy. “We lost a fortune on widgets this month. Buy twice as many widgets next time so we can make it up.”

Let’s use hypothetical situations. You are late to work, and a train is coming to the intersection up ahead. Would a conservative risk beating the train? Your gut says go. Your head says it’s not worth it. The last part, the most advanced part of the human brain to evolve, is the frontal cortex behind the forehead. That is where the brakes are. We have solid experimental results showing Republican college students scoring lower on IQ tasks that utilize the brakes.

You make $50,000 a year. The bank will loan you $200,000 for a mortgage. Do you buy a $200,000 or a $100,000 house? Conservatives don’t stretch budgets. Conservatives hate debt. A conservative would buy a $75,000 home, make double payments, and pay it off in 7 years instead of 30. He/she would then have a $75,000 equity to put down on a better home if they want to. Conservatives can count money. Conservatives understand opportunity cost.

There is a math test on Monday. You planned to study all weekend. Your buddies want to drink. The conservative argument is that it’s not worth it. It’s conservative to delay gratification. Being able to delay gratification is possible when your brain has evolved up to a higher developmental level.

Susie is super hot but unstable. Do you marry her? Do you let her be the mother of your children? What would be the conservative thing to do?

Smoking makes no sense to conservatives. Republicans have always sided with big tobacco.

Conservatives would never go without car insurance or medical insurance. Republicans opposed mandatory car insurance and medical insurance. Conservatives would never rationalize playing it fast and loose with medical risk by saying, “I’m young, and I won’t get sick.” The Republican Party still opposes public sector universal health care, the most cost-efficient and risk-averse form of coverage. Republicans still oppose helmet laws for motorcycle riders. That is not conservative.

Would a conservative eat at a fast-food stand in a country that did not provide universal health care and paid sick days for food handlers?

Would a conservative support a healthy federal unemployment program or just hope that they never get fired from a job, even though most people live very close to one or two paydays from bankruptcy?

Would a conservative favor a risky private-sector IRA stock market retirement system or a no-risk public-guaranteed social security system backed by the federal government?

Would a conservative start a war to secure oil for the US, or would he/she favor developing renewable energy sources that don’t fry the earth?

You are a conservative parent of a 16-year-old daughter. You know that the odds of sex happening are high. Do you give her birth control or risk a pregnancy? What is a safe strategy? Bending to not break is conservative. Think. She will be 18 in 24 months. You will have no control then. The risk is not worth 24 months of control. Conservatives can count. They understand trade-offs and opportunity costs. Conservatives play chess, not poker.

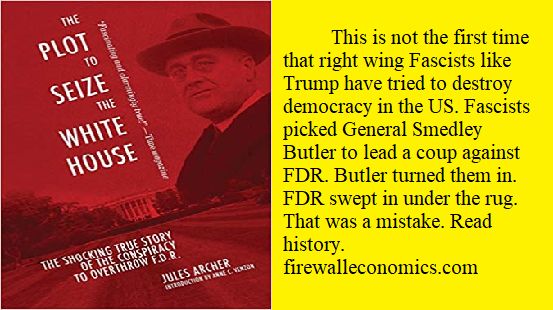

Conservatives judge you by what you do, not by what you say. Trump played it fast and loose. He went bankrupt four times. Is he a conservative? Would you loan him money? His business plan is to borrow as much money as possible, run up massive bills, refuse to pay the bills, and write off the debt in bankruptcy. Not conservative. That is not building your business on a rock. That is building your business on the sand.

Wall Street is the opposite of conservative. Realistic mortgages on single-family homes by local bankers who know the lender are conservative. Bundled up junk mortgages, derivatives, leveraged debt scams, credit default swaps, and other “creative” financial products are the opposite of conservative. Casino capitalism is not conservative. That’s why the banks keep crashing. That’s why they crashed in 1929. Too much leveraging. In 1929, you could buy stocks for 10% down and borrow 90%. Think. Which is frugal? Which is risk-averse? Which is the most conservative philosophy, Capitalism or Democratic Socialism? A universal safety net is good for Wall Street.

BTW, those new “innovative” financial products are not too complex to understand. That’s what the brokers want you to think. They are just ways to gamble. Derivatives are simply a bet on something that you expect to go up or down. It doesn’t even have to be a bet on something related to the product or the market involved. You might as well bet on how many runs the Cardinals score in a month. Wall Street bookies can calculate the odds with a computer and take a slice if you win or lose. Wall Street hires mathematicians for a reason.

So this isn’t anything like conservative Capitalism. What would conservative Capitalism resemble? Can we still go to the casino? Yes, but not until we pay the rent. What would be a short term reform strategy short of full-on Socialism?

Here comes my pitch. Firewall Economics is a soft landing for hardcore Capitalism. Conservative Capitalism can live with FE. If Capitalism and Socialism went to arbitration, FE would be the compromise that both sides could feel comfortable signing on to. FE, in a nutshell, sounds like Socialism for necessities and Capitalism for everything else. The Public Sector protects markets for necessities, but the Public Sector leaves all of the other markets alone. Public Sector protections would gradually expand over time, but only necessities receive protection in the short term.

FE is all about the deprivatization of markets for necessities. It removes the profit motive from markets for necessities. There can be no profit on medical care, but obscene profits on second homes and speed boats are allowed. The incremental implementation of public sector market protections makes it easy for investors to move investment capital from necessities to other markets. There are plenty of profitable markets that don’t involve the exploitation of necessities.

How do we define a Desperate Human Necessity? Rule of thumb: If you can not refuse to buy whatever it is, no matter what, it’s probably a necessity. If the seller has you over a barrel, it’s probably a necessity. If the seller quotes you a high price and you can’t walk away, it’s probably a necessity. Here is the formal definition for a Desperate Human Necessity in FE.

“A Desperate Human Necessity is any good or service that a consumer can not refuse to buy, at an exorbitant price, without borrowing money that they can’t afford to repay.”

The going into debt part is especially relevant to the payday loan industry. Predatory lending disables the economic law of supply and demand. Classical economic theory did not anticipate predatory lending. Once a seller begins to charge more than consumers can afford to pay, the seller should be forced to reduce the price or go out of business. Classical economic theorists did not imagine that lenders would loan money to borrowers that the borrowers clearly could not afford to repay. Modern Capitalists invented debt traps. Banks lend money to consumers who can not afford to repay the debt. That allows sellers to extort exorbitant prices from low-income consumers in markets for desperate necessities.

A single mother in a rural trailer court works at Walmart. Her heating oil seller triples the price of heating oil. He has a monopoly in the area. She can’t afford it. She borrows money from a payday lender and becomes entangled in a debt trap run by corporate loan sharks. The seller makes three times the fair profit. The payday lender thrives by loaning her loan after loan to cover the first loan. The business plan of the predatory lender is not to get paid back. The business plan is to be owed as much money as possible. Predatory lenders can bundle that bad debt and sell it to investors because investors know that once the debt bubble pops, the US government will bail them out. Too big to fail etc. FE protects markets for desperate necessities from scams like that.

You have been reading a little primer on Firewall Economics. I started by arguing that the Republican Party of today is the opposite of what most Main Street Republicans think of when they identify with a conservative philosophy. I then made the argument that FE is actually closer to the values of rank and file conservative Republicans than the hell-bent for leather capitalism of today.

FE has a free website where I explain the economic model in more detail, but it’s written for the general public. It’s not heavy and thick—no fuzzy math. My university professors warned me never to use the term common sense, but FE feels like common sense. Wall Street can make money in so many markets for goods and services that don’t put people over a barrel. Leave desperate necessities alone. Make money somewhere else.

firewalleconomics.com